Credit Card Processing - An Overview

Wiki Article

Payment Hub Fundamentals Explained

Table of ContentsVirtual Terminal Fundamentals ExplainedThe Basic Principles Of Payment Hub Some Of Comdata Payment SolutionsTop Guidelines Of Credit Card Processing FeesThe Only Guide for Fintwist SolutionsThe 3-Minute Rule for Virtual Terminal

Have you ever before questioned what takes place behind the scenes when an on-line settlement is made? If you are just beginning with business of e, Business and also on-line settlements or if you are just curious about the process it can be challenging to navigate the intricate terms used in the market as well as understand what each star does as well as just how.

: Review this write-up to obtain every little thing you require to find out about on the internet payment processing charges. Allow's start with the seller the person that uses goods or services to buy. A vendor is any type of individual or company that sells items or services. An e, Commerce merchant describes an event who offers items or solutions through the Internet.

You're probably wondering what a getting bank is well, it's a bank or financial institution that is a registered participant of a card network, such as Visa or Master, Card, and also approves (or gets) purchases for sellers, on behalf of the debit and credit scores card networks. We'll cover this in even more detail later in this post - credit card processing.

The Only Guide for Virtual Terminal

A for a certain seller. This account number resembles other unique account numbers issued by a financial institution (like a checking account number), however is especially utilized by the seller to determine itself as the proprietor of the deal information it sends to the financial institution, in addition to the recipient of the funds from the transactions.

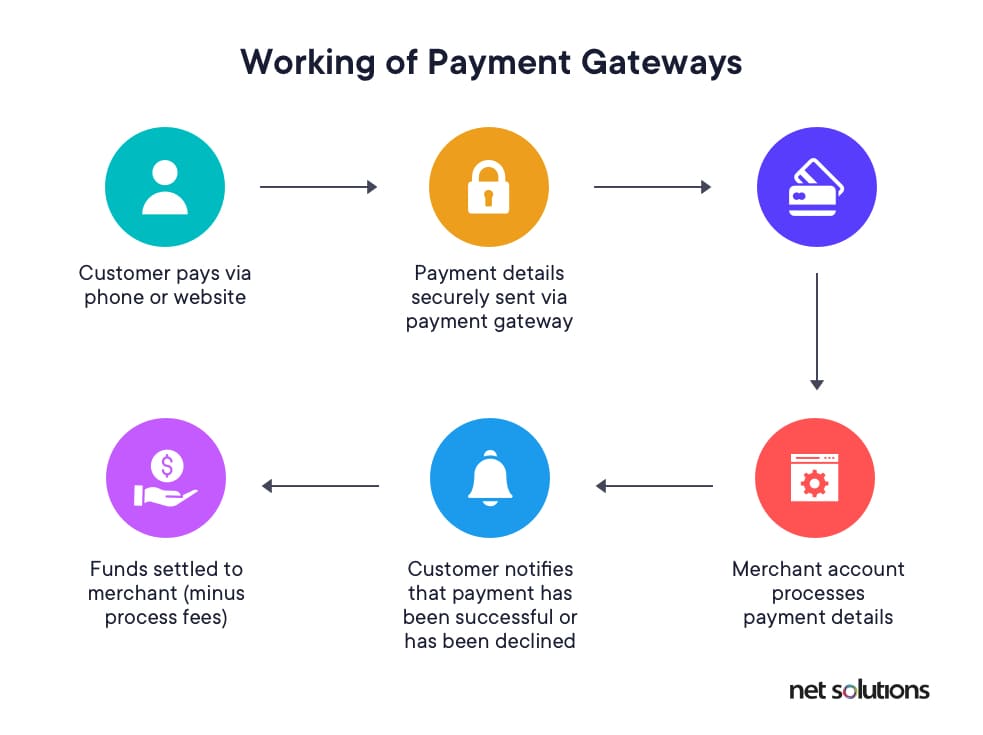

Once the seller has actually acquired a vendor account, whenever a consumer purchases a thing with a credit or debit card, the vendor sends the acquisition transaction details to the repayment processor used by its getting bank via a repayment gateway. A payment portal is a software that assists in the interaction of deal info.

The Of Fintwist Solutions

Visa, Mastercard, etc). The (e. g. in the instance of American Express) or speak to the card's releasing bank for consent (in the instance of Visa/Master, Card). A releasing bank is any type of financial institution or monetary institution that gives (or problems) credit or debit cards, via card associations. Exactly how Does an Issuing Financial Institution Work? An issuing bank is in charge of any kind of card owner's capacity to pay off the debt s/he collects with the bank card or line of credit report provided by the financial institution.A getting financial institution is a bank or monetary establishment that approves debit or credit card transactions for a cardholder. Exactly how Does click to find out more an Acquiring Bank Job? Acquirers/Acquiring banks are signed up participants of a card network, such as Master, Card or Visa, as well as approve (or acquire) deals on behalf of those debit and also charge card networks, for a seller (merchant services).

Whenever a cardholder makes use of a debit or charge card for a purchase, the obtaining financial institution will either approve or decline the deals based on the information the card network and providing financial institution carry record regarding that card owner's account. Besides taking care of transactions, an acquirer likewise presumes complete risk and duty connected with the purchases it refines.

What Does Payeezy Gateway Mean?

The providing bank then visit here communicates the result (approved/declined) and also the factor for it back to the repayment cpu, which will in turn communicate it to the merchant and buyer through the payment gateway. If the deal is approved, after that the quantity of the deal is deducted from the card owner's account and also the cardholder is given a receipt.The following action is for the vendor to satisfy the order placed by the customer. After the vendor has fulfilled the order, the providing financial institution will get rid of the permission on the consumer's funds and also prepare for deal negotiation with the merchant's obtaining financial institution. Credit Scores Card Interchange is the procedure in which an acquirer or obtaining financial institution submits authorized card transactions in support of its merchants.

The Only Guide for Credit Card Processing Fees

The obtaining bank then sends transaction settlement requests to the consumers' providing banks included. When all consents have been made and also all approvals obtained by the involved events, the issuing financial institution of the customer sends funds to the vendor's getting bank, through that bank's repayment cpu.This is called a negotiation pay or negotiation. For normal card purchases, also though the consent and also approval for order satisfaction take just secs, the whole payment handling circuit behind-the-scenes can use up to three days to be finished. As well as there you have it just how the settlements industry works, essentially.

Discover more terms and also concepts around on the internet payment processing by reading this complete guide.

An Unbiased View of Fintwist Solutions

Referred to as the cardholder's monetary institution. An Acquirer is a Visa/ Master, Card Affiliated Financial institution or Bank/Processor alliance that is in the business of refining charge card transactions for organizations as well as is always Obtaining new sellers. A vendor account has a selection of costs, some regular, others charged on a per-item or Source percent basis.Report this wiki page